Tax Relief Act 2024 Update Form

Tax Relief Act 2024 Update Form – Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. . Consequently, for the tax year 2024 Act of 2022 has expanded both the credit amounts and the types of qualifying expenses. To avail of this credit, taxpayers are required to file Form 5695 .

Tax Relief Act 2024 Update Form

Source : www.nerdwallet.com

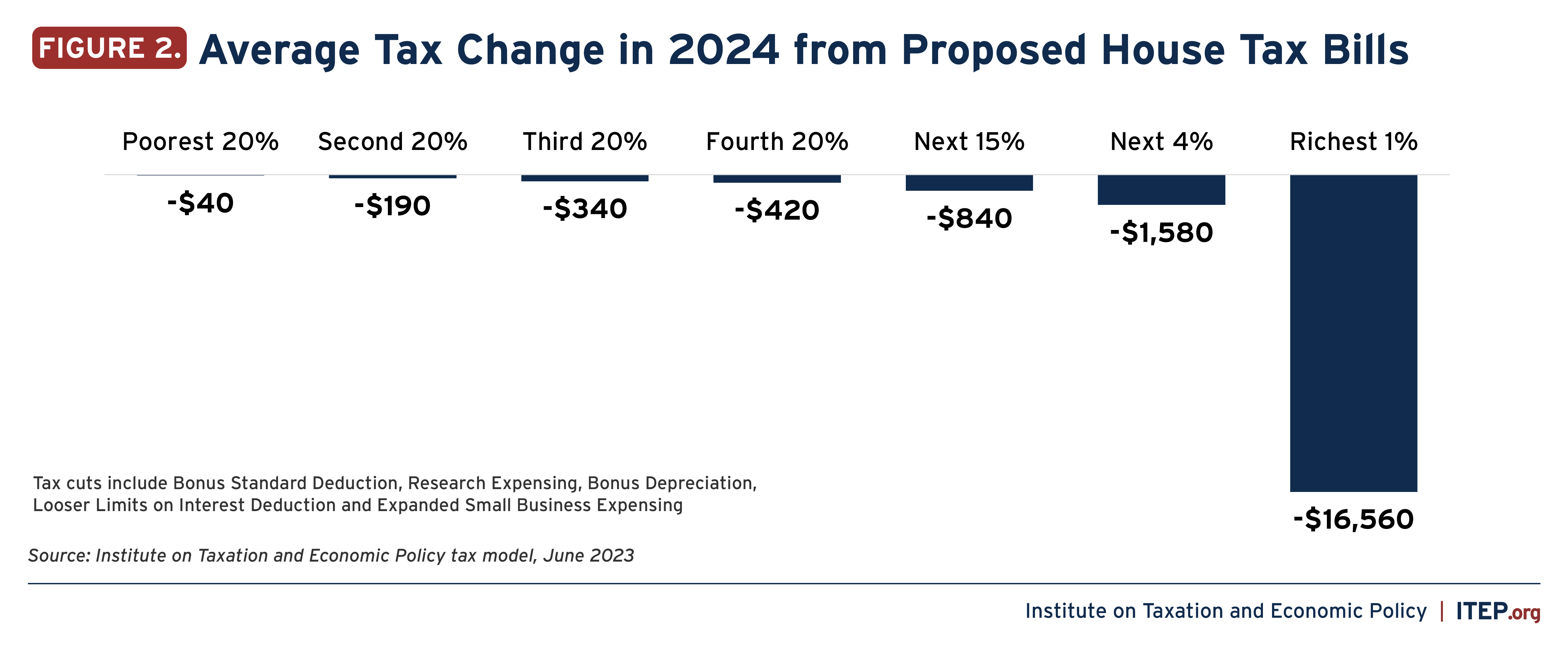

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

Business Tax Renewal Instructions | Los Angeles Office of Finance

Source : finance.lacity.gov

Tax and payroll reminders for the 2024 new year | UCnet

Source : ucnet.universityofcalifornia.edu

News Flash • Maximize Savings on Taxes with a FNSB Property

Source : www.fnsb.gov

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Boyer Financial Planning | Somerset PA

Source : www.facebook.com

Claim Recovery Rebate Credit 2024 RRC Status, Form, Who Qualifies?

Source : cwccareers.in

LEVERAGE SALT VOL. 7 fix sales tax exemption certificate

Source : www.linkedin.com

Tax Relief Act 2024 Update Form W 4: Guide to the 2024 Tax Withholding Form NerdWallet: The public saw more than 476 million payments totaling $814 billion in financial relief as Stimulus check update: this state’s residents qualify for tax credits In 2024, Gov. . This year, the IRS is partnering with eight companies that will offer tax prep and e-filed returns to those eligible. .