Wake County Property Tax Rate 2024 Calculator Estimate

Wake County Property Tax Rate 2024 Calculator Estimate – Homeowners in multiple towns across Wake County could see their property tax rate. The estimated rate this year is $0.4643 per $100 of valuation, according to county documents, although county . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential properties rose an average of 53% in tax value .

Wake County Property Tax Rate 2024 Calculator Estimate

Source : www.wake.gov

Wake County, NC Property Tax Calculator SmartAsset

Source : smartasset.com

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

How To Charge Sales Tax in the US (2024) Shopify USA

Source : www.shopify.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Wake County home values soar over 50% in property revaluations

Source : www.bizjournals.com

Revaluation FAQ | Wake County Government

Source : www.wake.gov

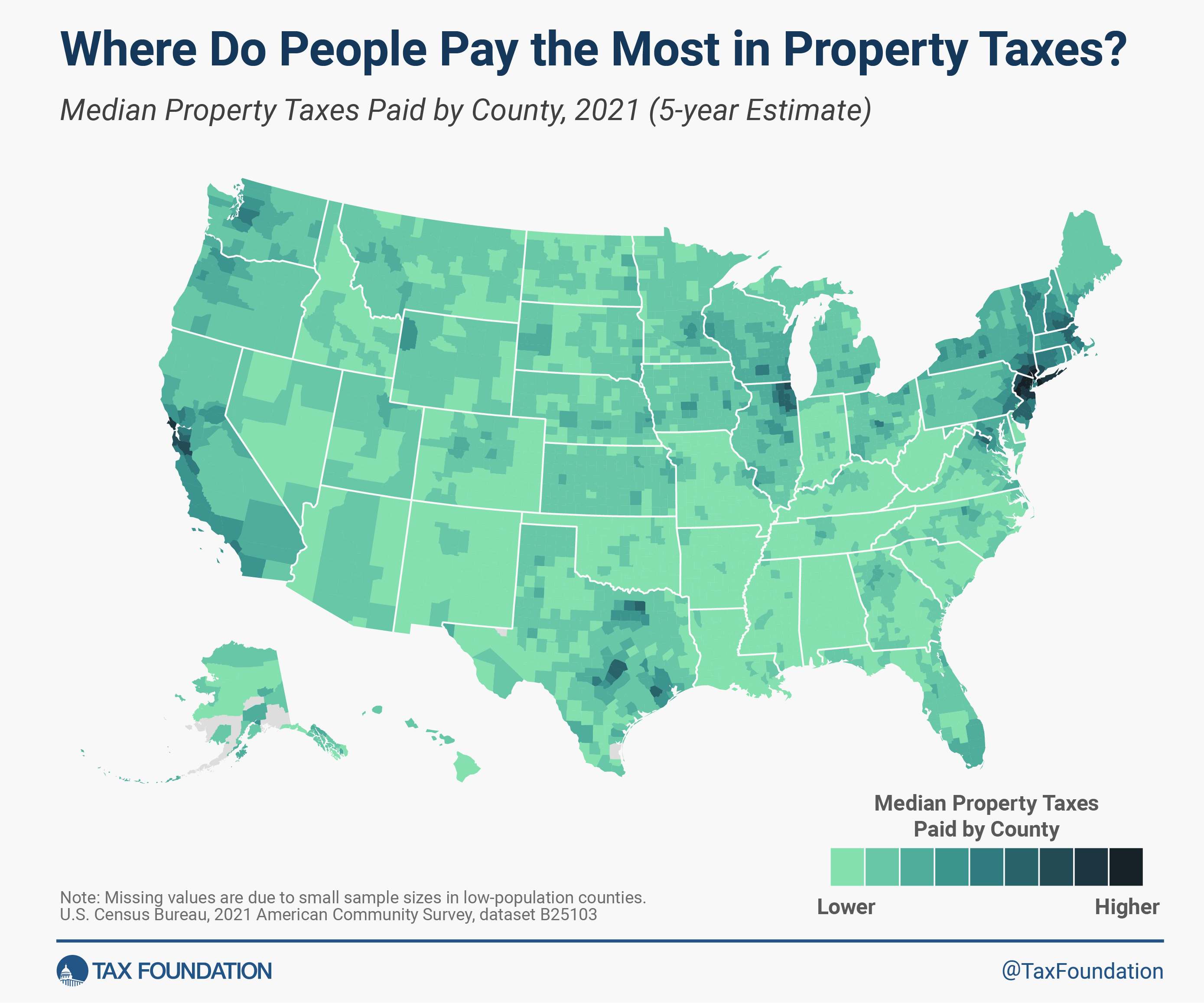

Property Taxes by State & County: Median Property Tax Bills

Source : taxfoundation.org

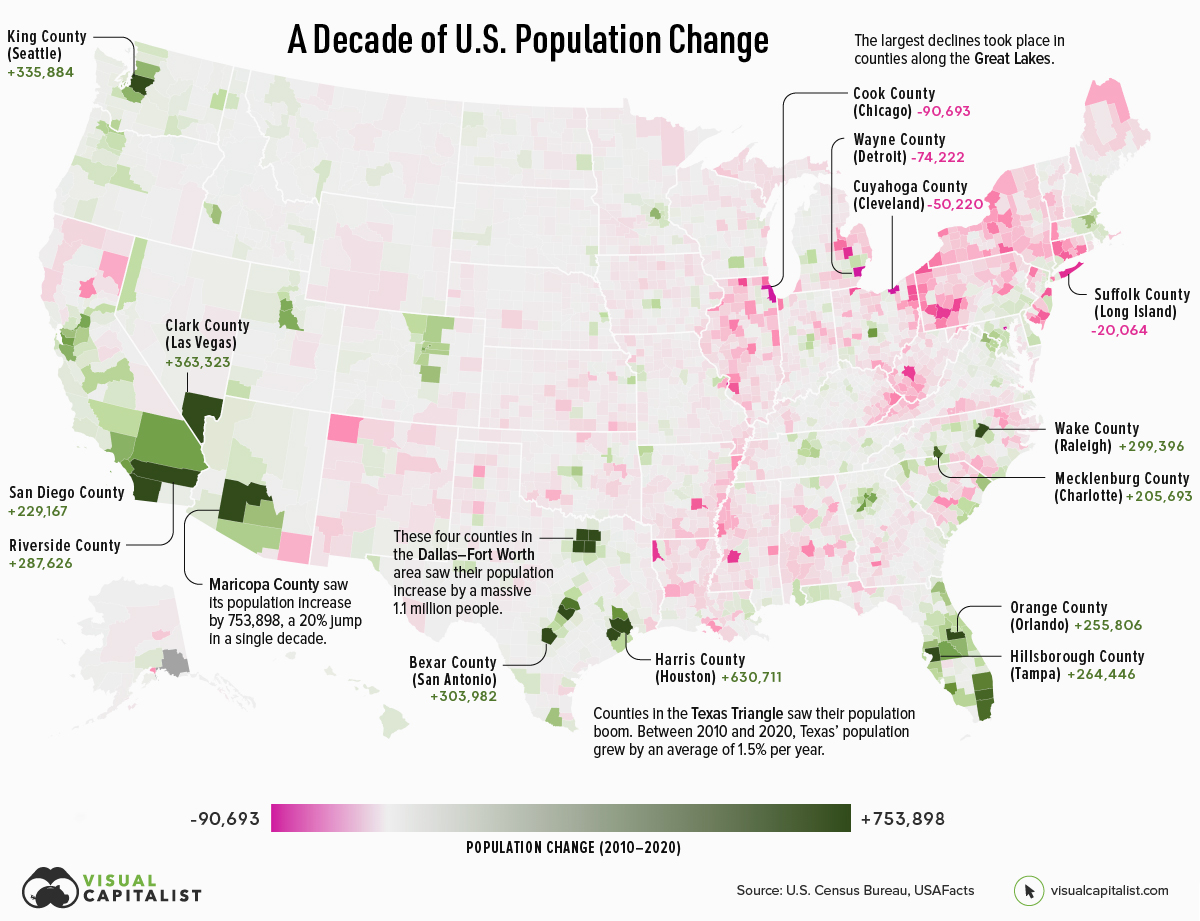

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

The Finch Blog Finch Unified Employment API

Source : www.tryfinch.com

Wake County Property Tax Rate 2024 Calculator Estimate New property value notices to hit Wake County mailboxes starting : Property values for more than 425,000 Wake County properties were updated through a combination of field visits and in-office analysis. . While it’s very likely Wake rate by your property Add any additional fees like waste or fire tax Kinrade said that if county leaders adopted the revenue neutral tax rate: based on an .